nj ev tax credit 2021

Drivers miss out on 5K rebate for electric cars if they bought them earlier this year. 0 You Save 3776 49500.

Coinbase Dashboard Illinois Bitcoin South Dakota

17 2021 1000 am.

. Heavy duty electric truck. Motor Vehicle Dealers Leasing and Rental Companies and Other Vendors. 17 2021 139 pm.

4200 0 You Save 3010 33745 BMW 2019 i3. New Jersey Earned Income Tax Credit We envision building a New Jersey where everyone can afford lifes basic needs. You worked for it now get it.

So im optimistic theyll get it. Colorados electric vehicle tax credits have been extended with a phaseout in place for purchases of electric vehicles in the following years. Because the 2022 credit will be a refundable tax credit probably 12500 in 2022 payable on my taxes in 2023 it.

Qualified Plug-In Electric Drive Motor Vehicles IRC 30D Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. Charge Up NJ EV Rebate NJ State Sales Tax 6625 Cost After Incentives. Nj ev tax credit 2022.

The Biden administration and carmakers are betting big on electric vehicles. NJBPU Launches Year 2 of Popular Charge Up New Jersey Electric Vehicle Rebate Program 0762021 Beginning Today Customers Can Receive up to 5000 Incentive at the Point of Purchase. 5432B-855 The New Jersey Sales and Use Tax Act provides a sales and use tax exemption for zero emission vehicles ZEVs which are vehicles certified pursuant to the California Air Resources Board zero emission standards for the model.

New Jerseys Energy Master Plan outlines key strategies to reduce energy consumption and emissions from the transportation sector including encouraging electric vehicle adoption electrifying transportation systems leveraging technology to reduce emissions and miles traveled and prioritizing clean transportation options in underserved communities to reach the. January 1 2020 to december 31 2022. Medium duty electric truck.

For vehicles acquired after 12312009 the credit is equal to 2500 plus for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity. Are there federal tax credits for new all-electric and plug-in hybrid vehiclesThis link will provide you an update by car manufacturer. NJEITC is a cash-back tax credit that puts money back into the pockets of working families and individuals including the self-employed who earn low to moderate income.

Audi 2021 e-tron 222. Sales Tax Exemption - Zero Emission Vehicle ZEV Sales Tax Exemption - Zero Emission Vehicle ZEV NJSA. I spent a week driving around New Jersey in two EVs to gauge how prepared the state is for them.

For medium duty and heavy duty vehicles the exemption is effective on and after March 1 2021. Tesla drivers recharge their. The deadline to order purchase or lease an eligible electric vehicle was Wednesday September 15 2021.

The Charge Up New Jersey Program has been successful for the second year in a row. In June 2021 New Jerseys Clean Energy Program NJCEP allocated a total of 7 million for Fiscal Year 2022 dedicating 6 million for use by state. Updated March 2022.

Credit for Buying a Hybrid. Do not shortchange yourself. After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandoned.

BMW 2020 i3 REX 168-223. Light duty passenger vehicle. Light duty electric truck.

As of August 2021 the US Senate through a non-binding solution has approved a 40000 threshold on the price of electric cars that would be eligible for a 7500 federal tax credit. New for Tax Year 2021. The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors.

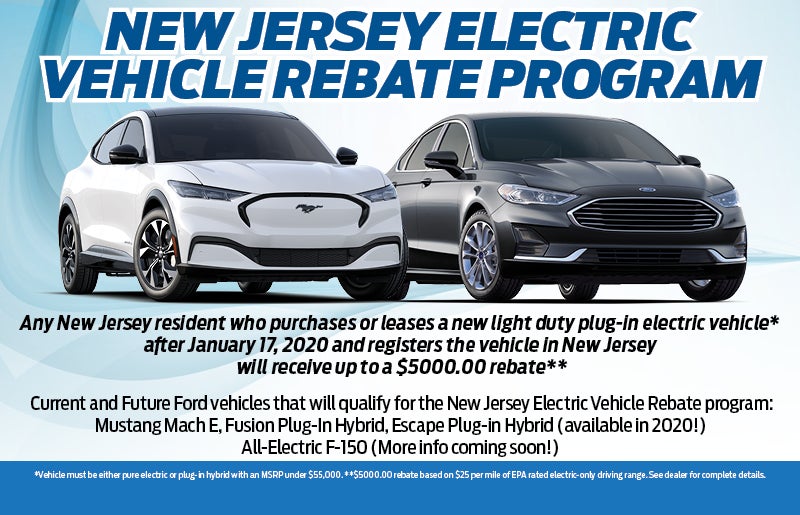

Charge Up New Jersey promotes clean vehicle adoption in the state by offering incentives of up to 5000 for the purchase or lease of new eligible zero-emission vehicles including. The deadline to order purchase or lease an eligible electric vehicle was Wednesday September 15 2021. In order to document the exemption for the sale lease or rental of a qualified zero emission vehicle the customer should complete an Exempt Use Certificate ST-4 and insert the statutory reference NJSA.

The Charge Up New Jersey Program has been successful for the second year in a row. 0 0 You Save 4366 58400 Audi 2021 e-tron sportback. So im optimistic theyll get it.

If youre ready to find your vehicle use the search below.

Home Drive Green Air Quality Energy And Sustainability Aqes Department Of Environmental Protection

Nj Resident Electric And Hybrid Vehicle Incentives Fred Beans Ford Of Langhorne

Home Drive Green Air Quality Energy And Sustainability Aqes Department Of Environmental Protection

Angelo Lamberto Angelolamberto Twitter

New Jersey Voters Support Full Transition To Electric Vehicles By 2030

New Jersey Offering 5 000 Off Evs Getjerry Com

New And Used Chevy Dealer In Freehold Nj Lester Glenn Chevrolet Of Freehold

Nj Electric Vehicle Rebate Program

Home Drive Green Air Quality Energy And Sustainability Aqes Department Of Environmental Protection

Home Drive Green Air Quality Energy And Sustainability Aqes Department Of Environmental Protection

New Jersey Electric Vehicle Ordinance What You Need To Know Revireo

Electric Vehicle Planning For Businesses Hotels Apartments And More Greater Mercer Tma

Eligible Vehicles Charge Up New Jersey

Honda Civic Sedan Tries Way Too Hard To Become A Type R Lookalike Carscoops Civic Sedan Honda Civic Sedan Honda Civic

Home Drive Green Air Quality Energy And Sustainability Aqes Department Of Environmental Protection

Home Drive Green Air Quality Energy And Sustainability Aqes Department Of Environmental Protection

N J Wants To Pay You To Buy An Electric Vehicle But It Hasn T Said When It Will Resume Doing So Nj Com